Welcome to Part 2 of me trying to make sense of emissions offsets and their place in a sustainable future. In this second part of the series, I am focusing in on emissions offsets and their legitimacy. If you missed part 1, here is a two sentence summary: The global climate is affected by our human activity, primarily through our emissions of greenhouse gasses. We can manage these emissions through avoiding, reducing, removing, or offsetting our emissions.

—

Where do offsets come from?

As carbon offsets and their respective marketplaces have grown in notoriety, questions have been raised regarding the legitimacy of the true contribution of emissions offsetting towards decarbonization.

Offsets are defined and issued based on specific protocols that govern and measure the impact made by offsetting projects. Once a project is registered it must be validated by a third-party to ensure that the project meets the criteria of the protocol. Then the outcomes of the project must be verified to ensure that the project actually achieved its claims. Once verified, offsets can be issued from the project to its stakeholders. With inconsistent policy and a lack in established regulatory bodies, this process can be (and often is) gamed by organizations to profit without actually providing additional benefit to the environment, or issuing credits before any real impact has been made.

—

So What?

This is a problem.

Fortunately, there are common concepts and frameworks to assess the quality, legitimacy, and value of offset development projects. We can deploy these key considerations in the world of emissions management and carbon offsetting to ensure that the sale of offsets is making a real and tangible contribution to the environment.

Baseline Assumption – The expected outcome without intervention. For instance, consider a protected forest in a national park – It is reasonable to assume that this forest will not be cut down. Or, A productive section of agricultural land – it is reasonable to assume that this land will continue to be utilized for agricultural purpose. Here’s a fun one; A high profit but high emissions business operation like resource extraction or refinement – it is reasonable to assume that this business model will continue as long as it is profitable and contributing to the economy.

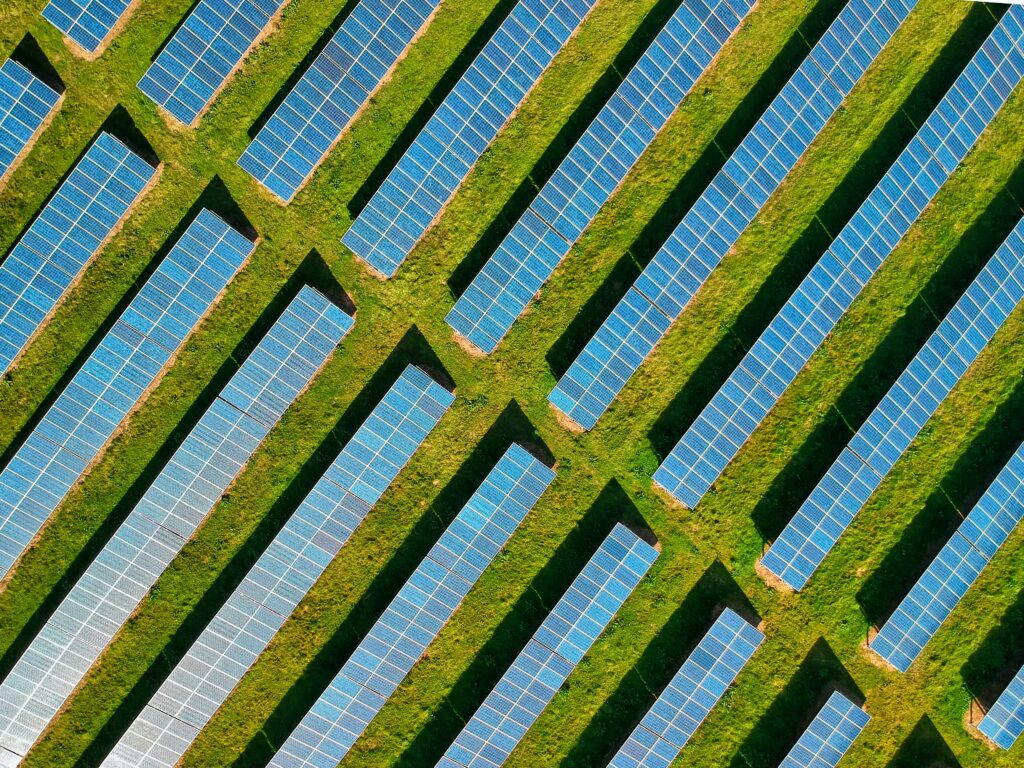

Additionality – Consideration of the change in expected outcome as a variation or deviation from the baseline assumption. This can take a few different forms, would it have happened without the money provided by selling offsets? Did it just displace the emissions to somewhere else? Would the avoided emissions activity ever have happened at all? For instance, Solar power has become much more economical and efficient over the past decade. So much so that the money saved by avoiding grid power utilization can pay for the costs of a solar implementation. In this scenario, the solar implementation does not satisfy additionality considerations. Alternatively, consider the harvesting of trees on steep, remote slopes; a dangerous and cost prohibitive process. A company electing *not* to harvest those trees does not meet additionality considerations because the baseline assumption is that those trees will remain in place.

Solar power has become much more economical and efficient over the past decade, so it is unlikely they will qualify for carbon market financing on most registries in the future.

Leakage – Does the project shift or displace the emissions to another location or process? For instance, in the wood products industry, the demand for lumber needs to be met by resource managers. Would avoided deforestation in one area lead to accelerated harvest of another? Or in the environmental restoration space, if one parcel of land is converted from agricultural use back to its natural habitat does that mean another habitat will be converted to agricultural use? Leakage can be complex to identify and mitigate. Fortunately, there are projects that provide a clear and transparent navigation. For instance: restoring marginal, unproductive lands back to their natural state. By avoiding market driven industries like agriculture and forestry, projects can create clear value additions to the landscape without risk of leakage.

Wood products are an important piece in sustainable development. A project that avoids the market driven pressures of the forestry industry is less likely to displace emissions elsewhere.

Intersectionality – Identification and management of interaction with other environmental or social issues. Some examples in this arena would be hydroelectric power and it’s impact on upstream ecosystems (flooding) and migratory patterns of aquatic species. In reforestation, does the project restore and maintain natural biodiversity and habitat of local wildlife, or is it a cost cutting monoculture? How does the restoration activity impact the food chain in terms of predator/prey dynamics? In addition to environmental concerns, project developers must also consider social interactions. How does the project impact food security in both developed and developing nations and territories? Critically important is consideration of and consultation with indigenous cultures or under-represented people groups.

Monoculture palm oil plantation adjacent to a species rich rain forest. Both are treed and sequester carbon but are not equal.

Permanence – The last consideration presented here is arguably the most important – does the value of the project endure over time? In most cases, the governing protocol defines the project lifecycle. There are mechanisms like buffer pools to mitigate the risk of reversals or total losses, but how can we be sure that a project implementation is protected? Project operators and developers should be able to clearly communicate a plan to establish and protect permanence. In the case of Wild + Pine, not only are our projects located in landscapes with rare occurrences of total loss events (wildfires, mountain pine beetle infestation), they are all destined to be placed into conservation with sustainably governed organizations such as the Nature Conservancy of Canada.

When a project can make it through the lens of the above considerations, and do so openly, it provides an avenue for tremendous value to the environment and establishes a traceable value chain from project operator to the end beneficiary.

—

We need to be better.

This system has been proven vulnerable but the market is there and maturing. As markets tighten their rules, project developers and those gaining unjust profit from the carbon market will be forced to change and shift their focus to beneficial projects that stand up to scrutiny. Projects with clearly verifiable emissions removal outcomes will step to the forefront, and illegitimate avoidance projects will be driven out.

End users are lined up and ready to purchase, the onus falls on the developers to ensure that their projects are transparent, rigorous, and beneficial to the environment, not just their pockets.

If you’re still with me, thanks! In part three of this series, I’m going to address how certain nature-based pathways are worthwhile investments and satisfy the considerations above to provide economical assets for environmental portfolios.

– Dave